Debunking the Climate Scam

Billions of Dollars -

Greedy Green Corporations -

No Warming For Two decades -

Bought and Paid For Organizations

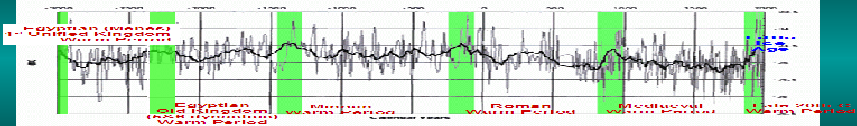

5000 Years Of Climate Change From Greenland Ice Cores

From: http://www.thegwpf.com/is-

Germany’s Green Energy Transition May Be Running Out Of Money, Study Warns

Date: 01/07/15

Andreas Mihm, Frankfurter Allgemeine Zeitung

The expansion of Green energy is costing billions. The strain on utilities is so heavy that they threaten to fall away as capital providers. Other investors are needed – but that is easier said than done.

The German energy transition has cost more than 100 billion euros so far. It has

hit large and small electricity suppliers with force and put traditional business

models in question. But 15 years after the start of the transition of the power sector

with the aim of renewable, low-

Quite possible, is the answer that the German section of the World Energy Council and the consultants from Roland Berger provide. In an unpublished study they come to this conclusion: “The necessary equity funds for the expansion of the network infrastructure and offshore wind can probably be provided only with the participation of alternative and international investors. High risks however make it questionable whether the investment needs can be met at a sufficient capacity and speed.”

New investors must be found

It is not about small change. At least 280 billion euros would need to be invested in the next 15 years in order to promote the politically demanded goal of the transformation of the energy system: from wind turbines, biomass plants and solar power plants to local, regional and national electricity distribution networks to large offshore wind farms. This calculation already includes “sustained political support”. Otherwise, it could get even more expensive.

The traditional energy companies – whether they be public utilities or large corporations – are no longer reliable. “Many traditional utilities, which previously financed investments in the electricity sector, mainly through their shareholders’ equity, are today with their backs to the wall,” says Uwe Franke, president of the German section of the World Energy Council, a global association of energy companies. He previously ran the business of BP Europe. Franke says, private and municipal suppliers lacked the investment funds. Therefore, new investors would have to be found to ensure “the energy transition and the security of supply.”

The prerequisites for this will vary. Money for photovoltaic systems, wind turbines on land and for biomass is there. “The necessary funds can still be provided by banks, households and project planners in the future”, according to the Berger study. In addition, the state could possibly easily help out with incentives.

“High risk and market entry barriers” and a “significantly tighter situation” are

however applying to investments in offshore wind farms and networks. In 2012 two-

When it comes to the distribution networks, weakened public utilities are faced with

a significant need for investment. Investors are additionally deterred by structural

reasons: the fragmentation in 900 network operators and the trend towards re-

Required equity questionable

For the transmission systems that transport electricity over long distances double-

According to the study, the utilities get under pressure from two sides. On one hand, many lack the capital for green energy investments. At the same time, big investors entered the market, driven by low interest rates and searching for attractive investments. Utilities could therefore lose their role as financiers and owners of installations and networks. At the same time its role as operators will be questioned by specialized project engineers and possibly soon also by equipment manufacturers.

Utilities should be more flexible, understand themselves more as a mediators and think in terms of cooperation. They could take the roles of fund initiators, fund service providers and financial investors. A business model opens at the interface of project developers and investors. “But this transition will not happen automatically,” says Franke. Utilities would have to change and understand the “energy transition as a capital transition”.

Translation Philip Mueller

-

| Warming Stopped |

| NOAA Data |

| NorthWest |

| Oregon |

| Washington |

| Extreme Weather |

| Past Was Warmer |

| NASA: 30's Hotter |

| PastBeliefs |

| HistoryOFAlarmism |

| Central England |

| Temperature History |

| MultiProxy |

| treemometers |

| Northwest Passage |

| Acidification-Ball |

| Acidification-Fulks |

| Acidification-Idso |

| Selected Emails |

| CRU Emails - html formatted |

| CRU Emails Simple Format |

| CRU Emails UnFormatted |

| DCPS paper |

| CRU_Files_Notice |

| False Deadlines |

| Hockey Stick Links |